Join Scott's Newsletter

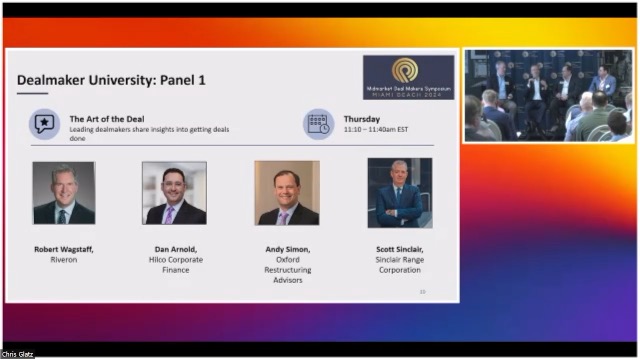

I had the privilege of attending the Mid Market M&A Symposium in Miami this month and to participate on the Deal Maker University panel.

My panel was asked to discuss changes in deal making in 2023 and expected in 2024. Some points raised and issues discussed included:

– Some sectors of the economy are doing very well but a lot of sectors are not.

– In many sectors, valuations are depressed or, worse, there are no bids at all.

– Yet, many vendors have expectations derived from years of abundant capital and unusually high valuations.

– Therefore, we urged a revisiting of fundamentals and structure creativity to, if possible, push the valuation issue to future periods.

– No cash roll ups are hot right now and are being used as a way to bulk up, reduce redundant costs and wait out the storm.

– Distressed deals are hot. We discussed the importance of narrative in pitching a distressed deal.